Total dairy export volumes out of Australia decreased 4% in June year-on-year, while year-to-date total dairy export volumes are still down 3%. From a value perspective and for the first time since February, total dairy export values declined, down 1% YoY in June; however, they are still up 6% YTD.

Milk powder exports had a mixed result with whole milk powder (WMP) exports declining YoY, while skim milk powder (SMP) exports increased YoY for June. WMP exports declined 44% YoY in June, with exports to Asia and China down 48% and 63% respectively, the largest reason for this overall decline. WMP exports to the Middle East attempted to offset this, with an increase of 840mt of WMP exported to the region. In fact, the Middle East followed this trend through both milk powders, with a massive 427% YoY increase in SMP volumes sent to the Middle East. There was also an increase of 54% into China. Overall, SMP exports increased 19% out of Australia in June.

Australian milk fat exports took a hit with anhydrous milkfat (AMF) and butter both experiencing declines. AMF exports out of Aussie in June declined a massive 46% YoY however, the YTD figure still sits up 6%. Again, a lack of Asian purchases drove this decline, with a drop of 49%. However this region still accounts for 93% of Australia’s June AMF export volumes. Butter exports followed suit, down 37% YoY and 30% YTD. Asia and China drove this decline, down 64% and 15%; however, China took nearly double the volume of butter in June that the rest of Asia did.

Continuing the trend of recent months – likely a result of favourable pricing – cheese and whey both increased export volumes out of Australia. Unlike milk powders and fats, Asia continues to purchase significant amounts of cheese and whey, not just from Australia, with exports out of the US also suggesting big volumes headed for Japan and Indonesia. Cheese exports increased 3% YoY, while whey exports increased a phenomenal 78% YoY. The story of the day, however, is the huge value increase of whey, with total export values up a massive 195% in June YoY.

Infant formula also continues to follow the trend occurring over recent months, with both Danone and Bubs AU winning contracts to the US for infant formula exports in the wake of the nation’s shortage. Infant formula exports increased another 16% YoY in June.

It is no surprise that exports have had declining month. Global constraints to shipping and production inputs have made farming and processing more difficult. Alongside this, farm sales and declining herd sizes in Australia have seen milk production become more expensive, resulting in increases likely to be relatively unattainable. Dairy production in Australia has fallen every month in the 21/22 season with a YTD variance of -3.5%. As a result, it is no surprise that dairy exports have fallen in June, and are unlikely to grow looking ahead.

GDT first Pulse results

The first of the trial Global Dairy Trade (GDT) Pulse events has resulted in a decline in the price of whole milk powder (WMP), with the only contract period sold, C2, declining 2.7% from the C2 price achieved at the previous GDT auction. The WMP price was US$3425/t.

This event saw 15 winning bidders from 33 participating bidders. The auction lasted two rounds and 938t was sold.

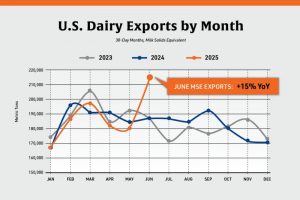

US dairy exports report record June

US dairy exports had a record month in June with total dairy export volumes up a massive 14% on 247,207mt while YTD figures increased 5%. All core commodities, with the exception of skim milk powder (SMP) increased, with Mexican purchases of dairy commodities driving the increases. Mexico’s imports of US dairy echo total US results, with increases of every commodity with exception to SMP.

Whole milk powder (WMP) exports into Mexico continue to increase, with a jump of 61% in June YoY while YTD figures are up a huge 38%.

While milk production in Mexico has been forecast to be stagnant according to reports out of the USDA earlier this year, increased demand from tourism and hospitality continues to drive demand out of Mexico, particularly for premium products such as imported dairy.

As that demand for premium products continues to increase, all other commodities saw big increases in June. AMF increased a colossal 946%, and while that is against no imports of US AMF in June 2021, the YTD figure is up a whopping 1179% with Mexico importing solid volumes of US AMF in 2022. Butter exports increased another 34% despite the global shortage, and YTD US butter exports into Mexico have risen 82%.

Cheese and whey exports out of the US have had a colossal year, and while Southeast Asia has taken large chunks of each commodity, June 2022 saw a record month for both commodities into Mexico with increases of 12% and 15% respectively.