The dairy giant is consulting with farmers over changes that could see the size of the fund capped or see it wound up completely.

Outside investors may not lose too much sleep if either of these changes come to pass.

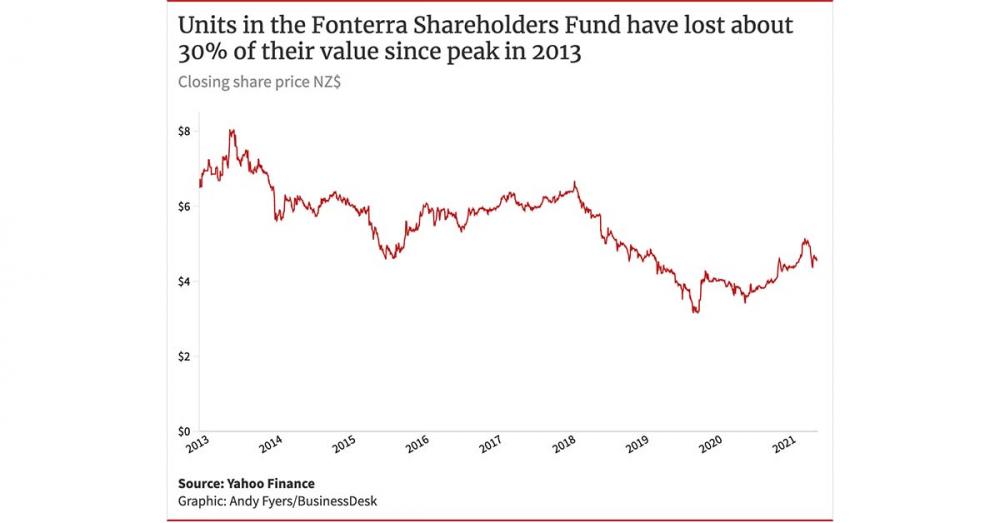

The fund has not exactly set the market alight since its inception in 2012.

After an initial burst which saw the value of units in the fund peak at $8.09 in March 2013, performance has been less than stellar.

The price took a hit following the whey protein recall later that year.

It slowly bounced back to $6.50 by 2018, but lost half its value in the next 18 months as the co-operative transitioned to new leadership, rejecting the strategy of the previous board and chief executive Theo Spierings.

Since then, the price has slowly recovered and currently sits at about $4.60.

The fund has returned an average of 30 cents per share in dividends since 2012.

BusinessDesk