Given that stock prices are usually aligned with a company’s financial performance in the long-term, we decided to investigate if the company’s decent financials had a hand to play in the recent price move. Particularly, we will be paying attention to Fonterra Co-operative Group’s ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

So, based on the above formula, the ROE for Fonterra Co-operative Group is:

12% = NZ$803m ÷ NZ$6.7b (Based on the trailing twelve months to July 2020).

The ‘return’ is the profit over the last twelve months. Another way to think of that is that for every NZ$1 worth of equity, the company was able to earn NZ$0.12 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company’s future earnings. Depending on how much of these profits the company reinvests or “retains”, and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don’t necessarily bear these characteristics.

Fonterra Co-operative Group’s Earnings Growth And 12% ROE

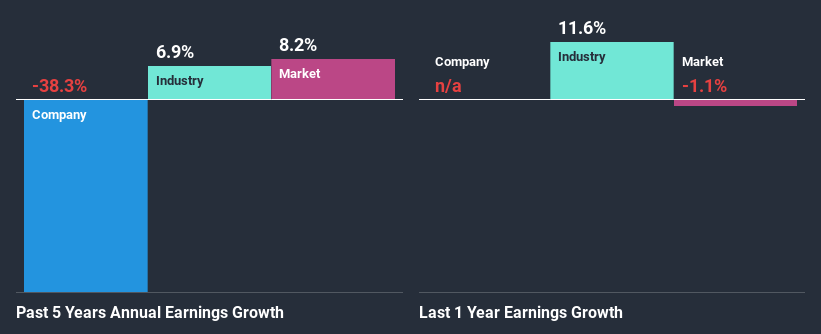

At first glance, Fonterra Co-operative Group seems to have a decent ROE. Further, the company’s ROE compares quite favorably to the industry average of 7.7%. Needless to say, we are quite surprised to see that Fonterra Co-operative Group’s net income shrunk at a rate of 38% over the past five years. Therefore, there might be some other aspects that could explain this. For example, it could be that the company has a high payout ratio or the business has allocated capital poorly, for instance.

However, when we compared Fonterra Co-operative Group’s growth with the industry we found that while the company’s earnings have been shrinking, the industry has seen an earnings growth of 6.9% in the same period. This is quite worrisome.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Fonterra Co-operative Group fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Fonterra Co-operative Group Efficiently Re-investing Its Profits?

Fonterra Co-operative Group’s low LTM (or last twelve month) payout ratio of 9.7% (or a retention ratio of 90%) over the last three years should mean that the company is retaining most of its earnings to fuel its growth but the company’s earnings have actually shrunk. The low payout should mean that the company is retaining most of its earnings and consequently, should see some growth. It looks like there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

In addition, Fonterra Co-operative Group has been paying dividends over a period of eight years suggesting that keeping up dividend payments is preferred by the management even though earnings have been in decline.

Summary

On the whole, we do feel that Fonterra Co-operative Group has some positive attributes. However, given the high ROE and high profit retention, we would expect the company to be delivering strong earnings growth, but that isn’t the case here. This suggests that there might be some external threat to the business, that’s hampering its growth. While we won’t completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. Our risks dashboard would have the 3 risks we have identified for Fonterra Co-operative Group.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.