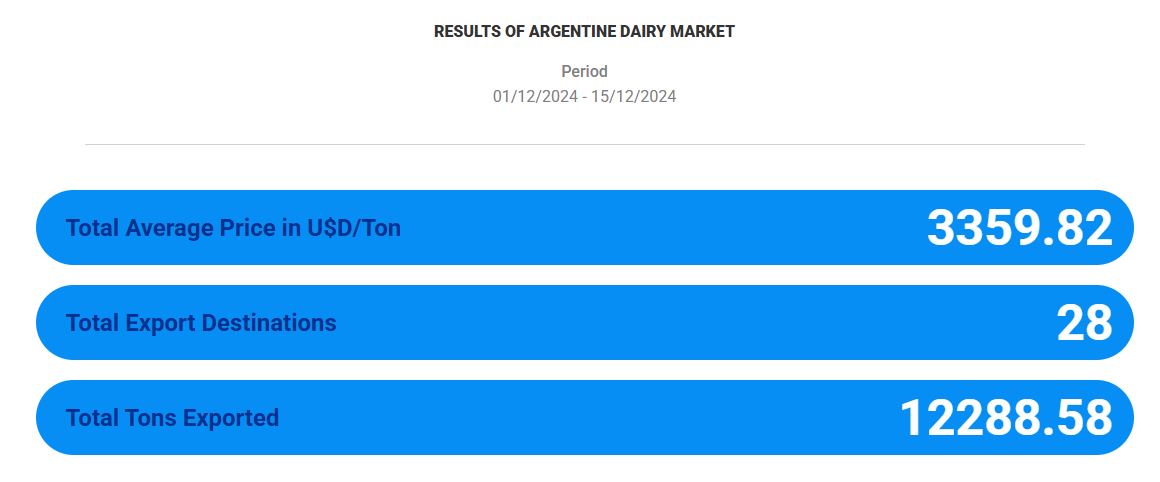

Argentina Dairy Market Analysis (01/12/2024 – 15/12/2024)

In the first half of December 2024, the Argentine dairy market showed a downward trend compared to the second half of November. The total average price per ton exported stood at U$D 3,359.82, which represents a 5.7% drop with respect to the U$D 3,562.60 recorded in the last 15 days of November.

The total volume exported also decreased, from 13,188.93 tons to 12,288.58 tons, reflecting a 6.8% contraction. However, the number of export destinations increased slightly, from 27 to 28 markets, suggesting greater diversification despite the fall in prices and volumes.

This decrease in prices and tons exported could be due to seasonal factors, variations in foreign demand or adjustments in local supply. It will be key to observe the evolution in the second half of December to determine if this trend persists or if it is a one-off fluctuation.

Summary by Product: Price and Variation

Whole Milk Powder:

- Price: USD 3,865.91

- Variation: +2.16%.

- Tons Exported: 5268.13

Skim Milk Powder:

- Price: USD 3.159,42

- Variation: +7,66%

- Tons Exported: 1154,97

Semi-hard cheese:

- Price: USD 4.501,34

- Variation: -0,38%

- Tons Exported: 928,88

Hard cheese: :

- Price: USD 6.328,36

- Variation: +1,07%

- Tons Exported: 380,71

Butter:

- Price: USD 6.274,92

- Variation: +5,04%

- Tons Exported: 947,87

ButterMilk:

- Price: USD 2.846,91

- Variation: +3,52%

- Tons Exported: 48,5

Whey Permeate:

- Price: USD 515,05

- Variation: -7,92%

- Tons Exported: 1060,4

Partially Demineralized Whey (D40%):

- Price: USD 1.018,41

- Variation: -0,11%

- Tons Exported: 1239,32

Whey Protein Concentrate Powder 35% (WPC 35%):

- Price: USD 2.052,44

- Variation: -0,15%

- Tons Exported: 1219

Whey Protein Concentrate Powder 80% (WPC 80%):

- Price: USD 7.000

- Variation: -12,45%

- Tons Exported: 40,8

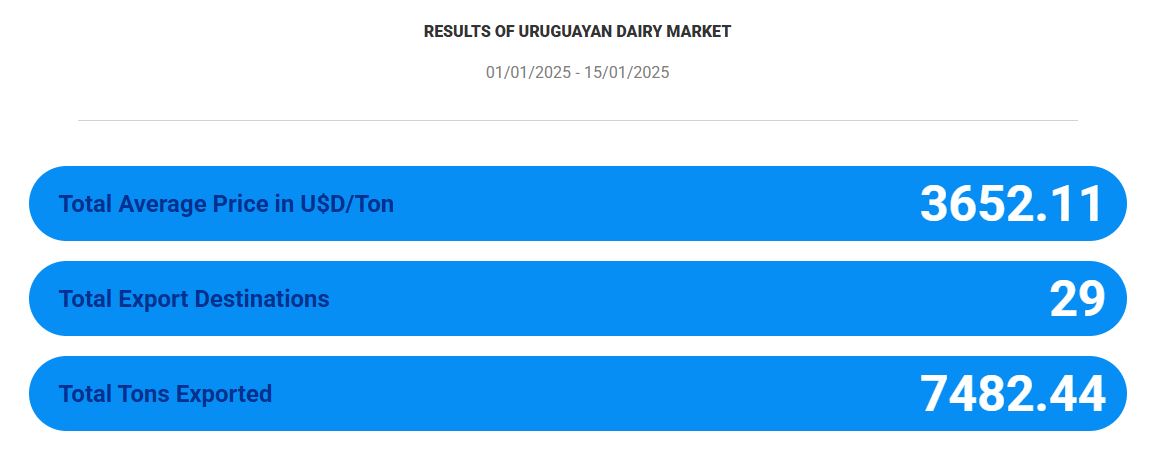

Uruguay Dairy Market Analysis (01/01/2025 – 01/15/2025)

In the first half of January 2025, the Uruguayan dairy market showed a slight decline in prices and a more pronounced drop in the volume of exports compared to the second half of December 2024.

The total average price per ton decreased by 1%, from 3,689.28 U$D in the second half of December to 3,652.11 U$D in the first half of January. As for the volume exported, the drop was more significant, with a reduction of 24.1%, from 9,852.81 tons in the previous fortnight to 7,482.44 tons in the period analyzed. This could be due to seasonal factors, post-end-of-year shipment logistics or lower product availability. On the other hand, the number of export destinations increased from 28 to 29.

In general, the first half of January shows a less dynamic start to the year in terms of exports, with slightly lower prices but with a broadening of the base of markets served. It will be key to observe whether this trend is reversed in the second half of the month.

Whole Milk Powder:

- Price: USD 3.715,06

- Variation: +1,36%

- Tons Exported: 6073,72

Skim Milk Powder:

- Price: USD 3.218,97

- Variation: +12,71%

- Tons Exported: 321,11

Semi-Hard Cheese:

- Price: USD 4.770,58

- Variation: -1,55%

- Tons Exported: 149,7

Hard Cheese:

- Price: USD 7.182,60

- Variation: +9,09%

- Tons Exported: 37,91

Butter:

- Price: USD 6.205,15

- Variation: +0,29%

- Tons Exported: 325

ButterMilk:

- Price: USD 3.376

- Variation: Exports were again recorded in this period

- Tons Exported: 50

Partially Demineralized Whey (D40%):

- Price: USD 1.060,76

- Variation: -3,57%

- Tons Exported: 525

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K