The interest in the sector also comes from this fact – Malaysia is highly reliant on fresh milk imports. In 2021, Malaysia imported almost 24 million liters of milk.

Given this and a growing demand for fresh milk, it is no surprise more companies are jumping on the milk bandwagon.

The latest to do so is Fraser & Neave Holdings Bhd (F&N), which announced a plan to venture into fresh milk production in Gemas, Negri Sembilan.

The beverage company, better known for its carbonated drinks and condensed milk, plans to buy Ladang Permai Damai Sdn Bhd, which will pave the way for F&N to make its foray into the fresh milk farming business.

F&N had been looking to embark on this business since 2019.

Its chief executive officer Lim Yew Hoe said owning fresh milk farms is part of the group’s long-term plan to be self-sufficient, achieve cost efficiency and reduce its carbon footprint.

Presently F&N imports liquid milk mainly from Australia for its milk-based products.

“The proposed acquisition is subject to the terms and conditions of the share sale agreement, including the government approvals to be obtained as conditions precedent to completion.

“More details of the project will be announced once they are completed,” he told reporters during the group’s financial results briefing for the first half ended March 31, 2022, on Thursday.

The proposed acquisition of Ladang Permai, for which F&N is proposing to pay RM215.59mil, will enable the group to enter the upstream fresh milk business for downstream production and distribution of fresh milk.

The acquisition includes eight parcels of agricultural leasehold land measuring an aggregate 2,726.48ha located in Gemas.

MIDF Research noted that the acquisition will be value-accretive for F&N.

“This will enable the F&N Group to own a vertical integration business and operations based on locally grown crops for feed to F&N’s dairy farm, which in turn will lower the value chain cost per liter.

“We think this will be beneficial for the group as it will be less dependent on imported milk for its production,” the research house said in a report.

This bodes well with F&N’s plans to mitigate increasing costs due to a spike in global commodity prices.

The proposed acquisition is expected to be completed by the third quarter of 2022.

F&N is currently sitting on RM1.8bil cash with almost zero debt level.

Milk self-sufficiency by 2025

Malaysia has set its sights on achieving 100% fresh milk self-sufficiency by 2025, according to the National Dairy Industry Development Programme.

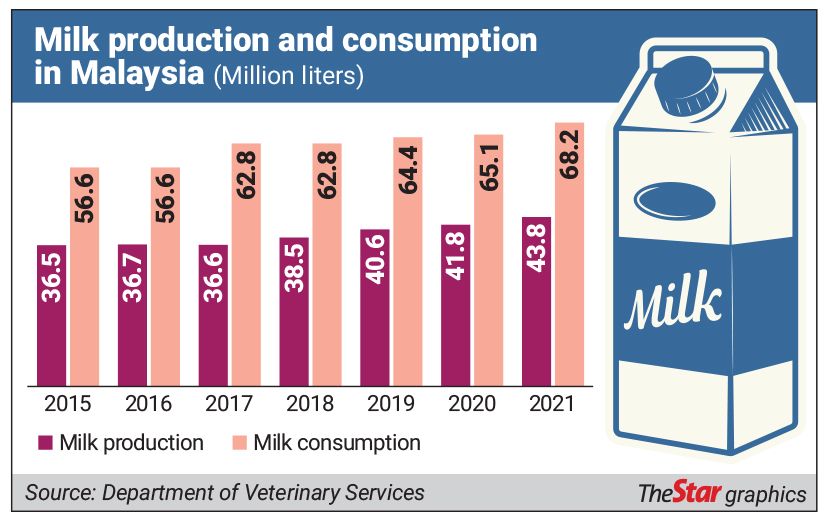

However, the country’s fresh milk consumption has continuously outstripped production.

According to data from the Veterinary Services Department, the country’s milk consumption has increased to 68.2 million liters in 2021 from 56.6 million liters in 2015.Meanwhile, milk production was at 43.8mil liters in 2021 compared with 36.5 million liters in 2015.

Aside from F&N, other listed companies are also vying the market. The world’s largest producer of crude palm oil FGV Holdings Bhd and animal health solution provider Rhone Ma Holdings Bhd have announced plans to venture into fresh milk farms.

There are two listed milk producers on Bursa Malaysia, namely, Dutch Lady Milk Industries and Farm Fresh. They are also market leaders in the milk market in Malaysia.

Dutch Lady commands over 40% of the liquid milk market share in Malaysia, and about 24% of the overall dairy market.

Farm Fresh is the second-largest player in the ready-to-drink milk category commanding an 18% market share, according to Frost and Sullivan.

It is the market leader in the chilled ready-to-drink milk segment with a market share of 42%.

It is worth noting that Dutch Lady Malaysia does not own any dairy farm in Malaysia. Farm Fresh currently operates five farms in Malaysia with a total area of 2,829 acres and a herd size of 5,961 dairy cattle.

It is not only Malaysia that is facing a milk deficit. According to a report by Rabobank on Dairy Export Boom Beckons in Asean-6 – With a Push or Pull, the combined annual milk deficit of the Asean-6 – Indonesia, Malaysia, The Philippines, Singapore, Thailand and Vietnam – is expected to grow to 19 billion litres in 2030, up from an estimated 12.9 billion litres in 2020.

There are various reasons why there is a gap in the milk farming business.

High feed costs, limited farming area and competitive milk imports from Australia were among the factors that constrained the growth of the milk production industry in Malaysia.

Companies going into the milk farming business will need to achieve economies of scale and fork out significant capital expenditure.