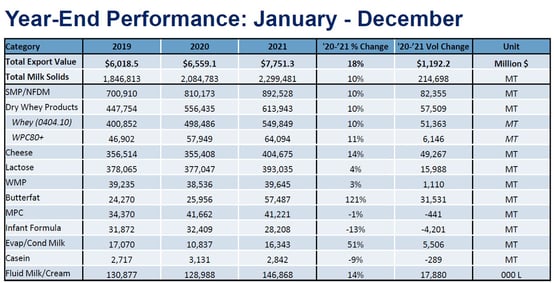

In December, U.S. dairy export value rose 17% even as year-over-year volume fell 4% for the month. Cheese exports, particularly to Mexico (+17%, +1,239 MT), starred during the month, posting a healthy gain of 20% (+5,204 MT). But flat milk powder volume and a significant decline in whey shipments in December provided a low-key finish to what turned out to be the best year ever for U.S. dairy exports.

An overall rebound in exports to Mexico and a sharp increase in whey and milk powder to China led widespread gains across products and geographies in 2021. With the December numbers now published, we see that U.S. dairy exports secured record highs in many key metrics and in the largest export categories:

- Total U.S. dairy export VOLUME grew by 10% (+214,698 MT MSE) over 2020 to reach 2.3 million metric tons of milk solids (MSE) shipped to overseas customers;

- Total U.S. dairy export VALUE surpassed the highs of 2014 to reach $7.75 billion in 2021, an 18% increase year over year;

- Cheese volumes also beat the 2014 record with a final total of 404,675 MT (+14%, +49,267 MT);

- NFDM/SMP built upon a successful 2020 (the previous record) and grew an additional 10% (+82,355 MT) to set a new record; and

- Whey exports – in both high- and low-protein varieties – reached new levels with 613,943 MT of whey products exported in 2021, also a gain of 10% (+57,509 MT).

More data and graphs from the latest trade data report can be found here.

There were multiple other records and success stories in the full-year data – whether broken down by market or product – that you can read more about in our press release.

Indeed, by all metrics, 2021 was a tremendous success for U.S. dairy exports.

What then does 2022 hold? Is a third year in a row of double-digit growth possible? To this analyst’s eyes – yes, it’s possible, but it certainly won’t be easy.

First, in 2021, U.S. dairy exporters managed to find success despite substantial headwinds from logistics. Lack of trucking availability, shortages of equipment and containers, carrier companies ignoring export orders for blank loads and, most recently, declining productivity at ports, have all taken their toll on U.S. exports – even though U.S. exports have clearly been positive.

Slower delivery times, higher shipping costs, unexpected fees and reputational damage all hurt U.S. exporters in key markets overseas and continue to limit the ability of U.S. dairy exports to reach their full potential due to lost sales, weaker returns, higher expenses, or all the above.

As we look to 2022, we expect many of these headwinds to remain – even as USDEC staff and policymakers look to find ways of easing the burden.

Fundamentally, labor issues at ports and lack of trucks to move product off crowded docks has limited the throughput of container vessels even as plenty of ships wait to be unloaded. Additionally, carrier companies continue to eschew containers filled with U.S. dairy products for empty ones. Given that the sharp price differential of Asia-to-U.S. freight rates compared to U.S.-to-Asia is expected to continue (driven by U.S. goods consumption), the practice of favoring empties will likely persist absent regulatory or legislative steps to tackle it head-on.

-Feb-08-2022-10-06-21-72-PM.jpg?width=554&name=Chart1%20(2)-Feb-08-2022-10-06-21-72-PM.jpg)

Second, slower-than-average U.S. milk production could limit product availability for export in the short term – even if overseas demand for U.S. dairy is plentiful.

In both 2020 and 2021, U.S. dairy exports grew by twice as much as domestic sales. However, it is worth noting, the supply environment was substantially different with milk production growing by 1.9% in 2020 and 1.7% in 2021.

For 2022, slower growth in milk production (and thus dairy product production) combined with the usual expansion of domestic consumption, as well as port congestion adding costs to exporting, will likely mean fierce competition to secure product. Certainly, exports will be a key component of that demand picture regardless of the short-term supply forecast, but more U.S. demand to satiate makes double-digit export growth challenging (but again, not impossible).

-Feb-08-2022-10-07-13-08-PM.jpg?width=554&name=Chart2%20(2)-Feb-08-2022-10-07-13-08-PM.jpg)

I do want to point out that we remain incredibly bullish about the U.S. having a clear opportunity to be the growing dairy supplier to the world. U.S. milk production growth should return to above 1% by the second half of 2022. And in the longer term, underlying supply-demand fundamentals, a supportive investment and policy environment and U.S. dairy’s commitment to international customers all signal long-term export growth potential. But short-term tightness in the market is likely to create headwinds to substantial growth in the near term.

Finally, on the data side of things, year-over-year comparisons to 2021 data will be strong across most major markets and products.

Perhaps the data-geekiest point, U.S. exports will be trying to match a record year with no laggards by market or product that would suggest low-hanging opportunities for booming volumes. Trade to all our major markets except New Zealand grew year-over-year, and all of the United States’ primary export products (along with most of the secondary ones) grew by double digits in 2021.

This final point is in sharp contrast to the comparisons used in 2020 and even 2021 as there were substantial opportunities in several markets. In 2020, U.S. exports to Southeast Asia had significant untapped potential after European intervention SMP flooded into the market at below-market prices the year prior. Additionally, the U.S.-China Phase I Agreement re-opened the door for U.S. dairy exports into the country in January 2020. By 2021, there was still plenty of opportunity to recapture market share in a booming Chinese market, particularly post-African Swine Fever, and Mexico’s import demand was sharply recovering after suffering from the worst of the COVID-19 pandemic in 2020.

To be 100% clear, there remain plenty of opportunities for growth in U.S. dairy exports. Demand is expanding around the world and competitors are struggling to keep up. But unlike the past two years where volumes were boosted by recovery in several key markets, 2022 growth will need to be built exclusively by new business.

Ultimately, even as export growth faces challenges in the short-term keeping up this record-setting pace, we believe U.S. dairy is still set up for long-term, sustainable success in growing export volume and value.

(For more information on our expectations of 2022, check out Part I and Part II of our recent “signpost” article, breaking down the key factors to influence global dairy consumption and trade in the year ahead.)