A mix of concerns negatively impacting sentiment among pastoral farmers saw New Zealand rural confidence drop for the third consecutive quarter.

The last quarterly survey for 2018 – completed in November – shows the nation’s net farmer confidence fell to -15%, down from -3% recorded in the September 2018 survey.

The survey found a decline in the number of farmers expecting agricultural economic conditions to improve in the coming 12 months (down to 14% from 20% in the previous quarter). An increased number of New Zealand farmers were expecting the performance of the agricultural economy to worsen (29% from 23% last survey). The number of farmers expecting conditions to remain the same stood at 53%, down from 54% previously).

Rabobank New Zealand general manager for country banking Hayley Gourley said while horticulturalists were more positive in their outlook, the overall drop in farmer confidence had been driven by greater pessimism among pastoral farmers.

“Horticulturalists’ net confidence flipped from negative to positive this quarter, rising from -4% last survey to +9%. However, there were significant falls in confidence for dairy farmers – with sentiment declining to a net reading of -21% from -9 % last quarter and for sheep and beef farmers, with confidence dropping to -12% from +7% previously,” she said.

“In both of New Zealand’s key pastoral sectors there are now more farmers expecting conditions in the agricultural economy to worsen in the coming year, than those expecting an improvement, and this is this first time we’ve seen this since quarter one 2016. This is particularly unusual during a period where product prices are at good levels and the climate has generally been favourable for most producers.”

Among those New Zealand farmers expecting conditions to deteriorate, the survey found the most significantly cited concern was government policies (45%) while falling commodity prices (37%), rising input costs (28%) and overseas markets (27%) also featured prominently.

“Rather than one single factor driving confidence lower, the survey results indicate a range of factors are responsible,” Gourley said.

“The proportion of farmers citing government policy as a reason for a negative outlook is relatively stable from last quarter, however, in this survey we’ve seen a jump in the number of farmers flagging concerns over falling commodity prices, rising input costs and overseas markets.”

Gourley said dairy farmers were chiefly behind the increased concerns around commodity pricing while both dairy and sheep and beef farmers were now considerably more worried about rising farm input costs.

“Almost half of dairy farmers expecting conditions to worsen cited falling commodity prices as a key factor with this likely to have been driven by lower pricing at recent Global Dairy Trade events and Fonterra’s downward revision of their 2018/19 forecast farmgate milk price in October,” she said. “Farmers from both pastoral sectors were also more concerned about rising farm input costs which have increased over recent months as a result of spiralling global urea prices that have increased local prices to $165 a tonne.

“In addition to these factors, the verbatim comments collected in the survey suggest Fonterra’s recent performance issues and Mycoplasma bovis are further areas of concern for farmers.”

Individual business performance

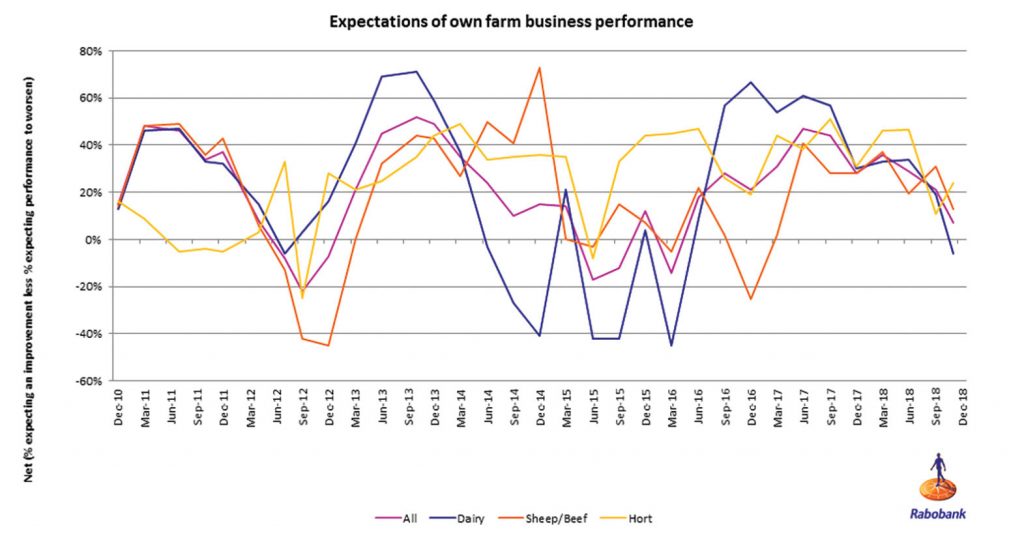

The survey found farmers’ confidence in their own farm business performance also down this quarter, dropping from a net reading of +21% last quarter to +7% this survey.

Expectations of own farm businessJust 26% of farmers now expect their own farm business performance to improve in the next 12 months (down from 34% last quarter), with 19% expecting performance to worsen (up from 13%). A total of 53% expected their business performance to remain stable (up from 52%).

“In line with the results for the agricultural economy, farmers in the dairy and sheep and beef sectors were less positive about the performance of their own business while horticulturalists were more optimistic,” Gouley added.

She said 34% of horticulturalists were now expecting their own business performance to improve in the next 12 months, up from 26% last quarter, while the number expecting performance to worsen fell from 15 to 10%.

“Overseas demand for New Zealand’s horticultural products remains strong while the conclusion of the Comprehensive Progressive Trans-Pacific Partnership (CPTTP) is a further recent boost for New Zealand’s horticultural exporters,” she said.

Dairy farmers expectations for their own farm business performance fell to a net reading of -6% (+19 previously) while sheep and beef farmers dropped to a net reading of +13% (+31 last quarter).

Farm investment

The survey found farmers’ investment intentions were also down on last quarter, but remained in net positive territory, with overall more farmers intending to increase than decrease investment in their farm businesses.

The survey found 24% cent of farmers were expecting to invest more in the coming year (down from 26% last quarter) and 12% were expecting to reduce investment (9% last quarter) – a net investment reading of +12%.

Gourley said lower confidence among pastoral farmers had flowed through to reduced investment intentions with sheep and beef farmers indicating a reduced appetite for investment in the coming 12 months, while dairy farmers had the weakest investment intentions of all farmer groups.

“Horticulturalists on the other hand had stronger investment intentions with 40% of growers now expecting to increase investment and only 2% expecting to invest less,” she said.